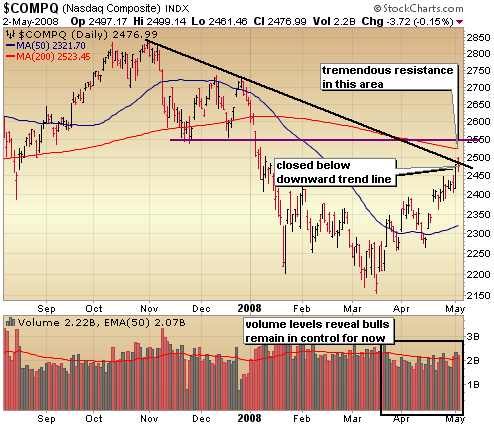

I’ll keep it fairly short this week. The indices haven’t done much since my last analysis and still look considerably bullish but that could change in a hurry as major resistance of the downward trends loom. As mentioned in the last analysis, where is the leadership going to come from if the oil and the ags continue to deteriorate? Is tech ready to finally step up in a big way? I don’t think it’s quite ready to do that.

After a more than 10% rise off those March lows I believe it’s time to begin getting more conservative and taking some profit off the table, especially if a big distribution day appears which we haven’t seen in quite some time. Let’s have a look at the indices.

You see that the volume levels still look good as buy volume continues to outweigh sell volume. There is certainly enough momentum to push us higher but keep a very close eye on that big resistance area of the downtrend. I think we’re going to have a heck of a time getting above that. . and if we do? Resistance of the 50 day moving average is not far behind.

The S&P edged up just a bit above resistance of the Feb highs and it too has some life left in it. I do think we’ll test that major resistance area of the downward trend at some point fairly soon. When we do, it’s time to take some chips off the table. Keep an eye out for a big, high volume reversal day which

often signals topping action.

Well how about the Dow! It’s already testing this major source of resistance. The battle between buyers and sellers should be mighty interesting next week. I mentioned the high volume reversal as a signal of topping action. Also keep an eye out for churning which is a higher volume day than the day before with very little price progress. That’s an indication that institutions are selling into rallies.

::: Model Portfolio :::

** This section will now appear as a separate report about every other Wednesday.

The Self Investors Model Portolio wrapped up 2007 with a 30.2% gain. Would you like to receive buy and sell alerts within minutes (NEW! now get them via instant messaging in near real time) of each transaction in the portfolio? You can receive these along with ALL of the tracking tools and reports with the very popular Gold membership. Don’t delay, get started today and join me for many more highly profitable months here at SelfInvestors.com.

::: Best/Worst Performers :::

– Top 10 Performing Industries For the Week –

1. Toy & Hobby Stores: 13.15%

2. Hospitals: 11.55%

3. Processing Systems & Products: 8.75%

4. Education & Training Services: 8.70%

5. Consumer Services: 6.70%

6. Investment Brokerage: 6.50%

7. Networking & Comm Devices: 6.30%

8. Research Services: 5.70%

9. Technical & System Software: 5.35%

10. Personal Services: 5.10%

– Top 10 Worst Performing Industries For the Week –

1. Computer Based Systems: -11.45%

2. Surety & Title Insurance: -10.55%

3. Silver: -10.20%

4. Major Airlines: -9.50%

5. Aluminum: -7.65%

6. Electronics Wholesale: -7.65%

7. Gold: -7.35%

8. General Entertainment: -7.00%

9. Music & Video Stores: -6.35%

10. Specialty Eateries: -6.00%

– Top 5 Best Performing ETFs For the Week –

1. MorganStanley China (CAF) 17.10%

2. SPDR China (GXC) 8.00%

3. Greater China Fund (GCH) 7.60%

4. Claymore China Real Estate (TAO) 7.45%

5. Ishares China (FXI) 7.40%

– Worst 5 Performing ETF’s –

1. Market Vectors Gold Miners (GDX) -8.05%

2. Asa Gold (ASA) -6.90%

3. iShares Silver (SLV) -5.60%

4. Powershares Agriculture (DBA) -5.25%

5. Central Fund of Canada (CEF) -4.90%

::: IPO’s Worth Watching for This Week :::

This section will now appear as a separate post on Mondays.

While 2008 should be a much slower year for IPO’s considering the deterioration of the market, there will continue to be some good companies coming to market here and there. I’ll be highlighting the best IPO’s every Monday.

::: Upcoming Economic Reports (4/28/2008- 5/2/2008) :::

Monday: None

Tuesday: Consumer Confidence

Wednesday: Fed Rate Decision, GDP, Chicago PMI, Crude Inventories

Thursday: Auto/Truck Sales, Initial Claims, Personal Income/Spending, PCE Core Inflation

Construction Spending, ISM Index

Friday: Nonfarm Payrolls, Unemployment Rate, Factory Orders

::: Earnings I’m Watching This Week :::

Monday:

Authentec (AUTH), BE Aerospace (BEAV), CDC Corp (CHINA), China National Offshore (CEO), Flowserve (FLS), FMC Technologies (FTI), Gen-Probe (GPRO), GFI Group (GFIG), Integral Systems (ISYS), Interactive Intelligence (ININ), Manitowac (MTW), Mastercard (MA), Portfolio Recovery Associates (PRAA), SOHU.com (SOHU), Southern Peru Copper (PCU), Titan Machinery (TITN), Visa (V)

Tuesday:

American Ecology (ECOL), American Medical Systems (AMMD), Archer Daniels Midland (ADM), Banco Bradesco (BBD), Compania de Minas Buenaventura (BVN), Countrywide Financial (CFC), Cybersource (CYBS), Express Scripts (ESRX), General Cable (BGC), Genesee & Wyoming (GWR), Monolithic Power Systems (MPWR), Open Text (OTEX), Ritchie Bros (RBA), Santander Central Hispano (STD), TheStreet.com (TSCM), Under Armour (UA), VistaPrint (VPRT)

Wednesday:

Centex (CTX), Central European (CEDC), Central European Media (CETV), Chicago Bridge & Iron (CBI), Concur Tech (CNQR), Cummins (CMI), First Solar (FSLR), Garmin (GRMN), Intellon (ITLN), Oceaneering (OII), Omniture (OMTR), Proctor & Gamble (PG), Psychiatric Solutions (PSYS), Strayer Education (STRA), Tetra Tech (TTEK)

Thursday:

Bankrate (RATE), Cameron (CAM), Chart Industries (GTLS), Chesapeake Energy (CHK), Comcast (CMCSA), ExxonMobil (XOM), Green Mountain Coffee Roasters (GMCR), Hologic (HOLX), Hornbeck Offshore (HOS), Investools (SWIM), Natus Medical (BABY), Noble Energy (NBL), Novamed (NOVA), Pride Intl (PDE), Rowan Companies (RDC)

Friday:

Agrium (AGU), Chevron (CVX), Intercontinental Exchange (ICE)

::: In Case You Missed It – SelfInvestors Blog Entries of the Past Week :::

1. Google Catalyst for Big Break, But Big Resistance Remains

2. Hot IPO’s: Intrepid Potash (IPI) & American Water Works (AWK)