I’ve been talking quite a bit about the formiddable resistance areas the indices are now testing and not much has changed there, so I’ll keep it brief and just throw up the charts. Actually, the real reason is that it’s Sunday and a real beauty in Seattle where I’m visiting for the weekend. The last thing I want to be doing is discussing the market.

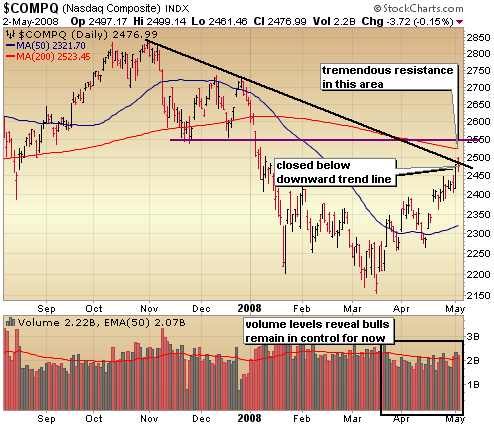

The Nasdaq briefly took out the downward trend line on Friday but ultimately closed below this important level of resistance. While volume levels still indicate that bulls are in control, the market is currently very much oversold and facing formiddable resistance levels. I think we could get another 2% out of this run, but I’ve already begun paring back long positions. Be on the lookout for distribution or churn days to signal that this run has fully run its course. We haven’t seen this yet, but it should happen soon.

The S&P cleared and held above the downward trend line on Friday, clearing the way for a potential test of the next level of resistance around the 200 day moving average. There appears to be some momentum left in this market which should carry the S&P up to this level, but as I said above be on the lookout for distribution. That will signal the beginning of the end for this rally.

I mentioned in the last report that I thought it would be difficult for the Dow to get above the downward trend line and if so it would still have to face tough resistance of the 200 day moving average. Well, it’s cleared the downtrend and briefly nudged above the 200 day moving average. An impressive showing for the Dow for sure and if distribution doesn’t show up soon it could very well test the next level of resistance just above 13500.

::: Model Portfolio :::

** This section will now appear as a separate report about every other Wednesday.

The Self Investors Model Portolio wrapped up 2007 with a 30.2% gain. Would you like to receive buy and sell alerts within minutes (NEW! now get them via instant messaging in near real time) of each transaction in the portfolio? You can receive these along with ALL of the tracking tools and reports with the very popular Gold membership. Don’t delay, get started today and join me for many more highly profitable months here at SelfInvestors.com.

::: Best/Worst Performers :::

– Top 10 Performing Industries For the Week –

1. Major Airlines: 13.05%

2. Confectioners: 12.65%

3. Credit Services: 8.85%

4. Asset Management: 8.65%

5. Regional Airlines: 8.20%

6. Education & Training Services: 7.80%

7. Long Term Care Facilities: 7.45%

8. Food Wholesale: 7.20%

9. Toy & Hobby Store: 6.90%

10. Grocery Stores: 6.70%

– Top 10 Worst Performing Industries For the Week –

1. Heavy Construction: -7.40%

2. Farm Products: -6.85%

3. Music & Video Stores: -6.30%

4. Nonmetallic Mineral & Mining: -6.20%

5. Silver: -6.05%

6. Cigarettes: -5.20%

7. Copper: -5.00%

8. Packaging & Containers: -4.95%

9. Agricultural Chemicals: -4.90%

10. Medical Practitioners: -6.00%

– Top 5 Best Performing ETFs For the Week –

1. Greater China Fund (GCH) 11.30%

2. Morgan Stanley China (CAF) 11.20%

3. Japan Small Cap (JOF) 7.20%

4. iShares Brazil (EWZ) 6.60%

5. Morgan Stanley (IIF) 5.40%

– Worst 5 Performing ETF’s –

1. Market Vectors Agribusiness (MOO) -5.20%

2. Market Vectors Gold Miners (GDX) -4.75%

3. Asa Gold (ASA) -4.60%

4. SPDR Materials (XLB) -3.35%

5. Malaysia Fund (MAY) -3.30%

::: IPO’s Worth Watching for This Week :::

This section will now appear as a separate post on Mondays.

While 2008 should be a much slower year for IPO’s considering the deterioration of the market, there will continue to be some good companies coming to market here and there. I’ll be highlighting the best IPO’s every Monday.

::: Upcoming Economic Reports (5/4/2008- 5/9/2008) :::

Monday: ISM Services

Tuesday: None

Wednesday: Productivity, Pending Home Sales, Consumer Credit, Crude Inventories

Thursday: Initial Claims, Wholesale Inventories

Friday: Trade Balance

::: Earnings I’m Watching This Week :::

Monday:

Alpha Natural Resources (ANR), Cleveland Cliffs (CLF), Continental Resources (CLR), eResearch (ERES), Gafisa (GFA), Partner Communications (PTNR), Tidewater (TDW), Vulcan Materials (VMC)

Tuesday:

Banco Itau (ITU), Blue Nile (NILE), Cisco (CSCO), Corrections Corp (CXW), DR Horton (DHI), Henry Schein (HSIC), NYSE Euronext (NYX), Simcere Pharma (SCR), Sun Hydraulics (SNHY), Synchronoss Tech (SNCR), Ultra Petroleum (UPL)

Wednesday:

AirMedia (AMCN), Allis Chalmers (ALY), American Oriental (AOB), Clean Harbors (CLHB), Credicorp (BAP), Crocs (CROX), Devon Energy (DVN), Expeditors Intl (EXPD), Foster Wheeler (FWLT), FTI Consulting (FTI), Hansen Natural (HANS), Mindray Medical (MR), Perini Corp (PCR), T3 Energy Services (TTES), Yamana Gold (AUY), Transocean (RIG)

Thursday:

Aecom (ACM), Akeena Solar (AKNS), Arena Resources (ARD), Balchem (BCPC), Ceco Environmental (CECE), Dawson Geophysical (DWSN), Delta Petroleum (DPTR), Flotek (FTK), Global Industries (GLBL), Koppers Holdings (KOP), NGAS Resources (NGAS), Nvidia (NVDA), Pioneer Drilling (PDC), Priceline.com (PCLN), Ricks Cabaret (RICK), NASDAQ Group (NDAQ), Toyota Motor (TM), Unibanco (UBB), Watson Wyatt (WW)

Friday:

Rosetta Resources (ROSE), US Global Investors (GROW)

::: In Case You Missed It – SelfInvestors Blog Entries of the Past Week :::

1. Barry Hot on the Heels of the Plunge Protection Plunge Team

2. Visa (V) Vs. Mastercard (MA): Earnings Results

3. Peak Oil, Peak Water.. We’re All Gonna Die

4. Buying International Stocks