Hey all, I just put up an outline page of the new INO email stock market trading course that I highly recommend. I’ve gone through it myself and there are some great advanced tips, not just the stock market basics. It’s a 10 day course that covers everything from trader discipline to gaps, to reliable chart patterns, to stochastics to topping and bottoming signals. Even if you’re experienced, it’s worth a look. Maybe there are some indicators and patterns you hadn’t considered. You have nothing to lose by checking it out.. it doesn’t cost a dime. Get a course syllabus and sign up for the stock market course here.

All posts by Tate Dwinnell

The Case For Bear Vs Bull Market

I wanted to post an email I sent out to my members last night, going over the case for a bull vs bear market. Comments are welcome and appreciated!

What a yo yo couple of weeks it’s been with the market bouncing around in a fairly tight trading range. The market doesn’t know what it wants to do up here and that makes it difficult for a trader to know what to do as well. I still think the best strategy up here for most people is to move more to cash, lock in gains quickly if your playing momentum stocks and stick to dividend payers if you’re planning on holding for a longer time period.

The case could certainly be made on the bullish and the bearish side, but in my opinion when you make the case for both, you have to give the advantage to the bearish side up here. Let’s a take a look at both.

The Bull Case

– Market still trading up around the highs of the year despite quite a bit of bad news (ie the quick recovery off Dubai debt concern)

– entering a month that is historically a bullish time for the market

– liquidity, liquidity, liquidity.. this could really go under the bullish case and bearish case (are we creating another bubble fueled by excessive risk?)

– the recession is over! (ok, I say that with some sarcasm, because I don’t truly believe we’re out of the woods and I get sick of hearing the argument that the market will continue to move higher because the coast is now clear. It isn’t and most of the good news has been built into this market now)

– there must be a few more points to make the bullish case, but I’m not coming up with them. Send me your best bullish case and I’ll have a little something for you.

The Bear Case

I think we’re all aware of the economic concerns out there such as inflation (down the road), rising unemployment, BIG government, rising taxes, etc, so I’ll just discuss the technicals for the bear case

– trouble at key resistance levels around Dow 10500, Naz 2200 and S&P 1100

– S&P and Dow hitting big resistance of the downward trend line off the 2007 highs (I’ll draw out these charts at the blog soon)

– volume continues to diminish to the upside

– Dow, Naz, S&P back into overbought territory on the weekly charts

– small caps are broken as revealed by the break down in the Russell 2000

– US dollar stabilizing as it hits big support of 2008 lows (a rally could derail the market)

– the financials failed at key resistance today as revealed by the XLF (high volume reversal at 50 day moving average)

What do you think? Have I missed anything? Can you make a stronger case for the bull side? I’d like to hear your opinion and I’ll publish the best responses over at my blog.

As for the action today, we got some hefty selling there in the last few minutes of trading ahead of the jobs number in the morning. Is that move forecasting an awful jobs number in the morning? We’ll find out. The rumor this morning was the White House knows the report and unemployment ticked up. The White House denied the rumor and the market rallied a bit. We’ll get the truth in the morning.

The market just remains in a tight range right now with two straight days of failed break out moves, but still with lots of support below. I’ll be keeping a close eye on the resistance levels of the highs of today and the support levels of the 50 day moving averages – at Dow 10000, S&P 1080 and Nasdaq 2100.

Forex Trading Strategy From MarketClub

Adam Hewison of MarketClub just released a new video revealing his forex trading strategy using their proprietary trade triangle technology. He basically uses a monthly chart to focus on longer term trends, entering and exiting when the trade triangle technology reveals a shift in the trend. Highlighted in the video are the entry and exit points over the past eight years for the USD/CAD, USD/NZD and EUR/USD.. What you’ll see is that focusing on the longer term trends is a good forex trading strategy.

The forex markets are the biggest markets in the world and MarketClub not only covers all of them, but also covers them in real-time with pricing and charts. Learn from the video and post your comments at their blog!

Click the video to watch Adam’s long term forex strategy in action.

Smart Grid ETF (GRID) Begins Trading

The government is pouring billions into the technology. Cisco CEO John Chambers said it will be bigger than the internet. The opportunity for investors is indeed BIG and now there’s a diversified way to play “it” – the smart grid revolution.

There are quite a few useless and overlapping ETF’s out there and this industry is in need of a major shakeout, but every once in awhile a great ETF comes along and the First Trust/Clean Edge Smart Grid ETF (GRID) is no exception. The ETF aims to track the NASDAQ OMX Clean Edge Smart Grid Infrastructure Index and is a modified market cap weighted index which includes companies that are primarily engaged in all components of the smart grid – from the meters, to the network, to energy storage to software.

The fund aims to focus primarily on smart grid plays by weighting those companies deemed as smart grid “pure plays” much more (80%) than big companies with a fraction of their business in the smart grid arena (weighted at 20%). For example, a company like Itron (ITRI) is going to comprise a much larger portion of the ETF than a GE would.

:: >> Get More Analysis On the Smart Grid ETF (GRID) Here

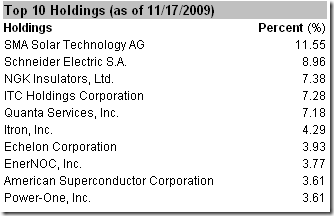

The ETF is comprised of 29 companies, but here are the top 10 holdings. Companies must have a minimum float adjusted market capitalization of $100 million and a 3 month avg daily dollar trading volume of $500K.

Other smart grid plays included are AEIS, COMV, DGII, ESE, BGC, GE, ITLN, ITC, MTZ, PIKE, SATC, VMI, WCC, ABB, CBE, JST, TLVT, SI, NGG

Here’s a prospectus of the Smart Grid ETF (GRID)

After just two days of trading, the Smart Grid ETF (GRID) offers plenty of liquidity, trading 200K shares today. I’d imagine liquidity will continue to improve rapidly in the coming months for you short term traders out there.

Dick Bove’s Wells Fargo (WFC) Sell Rating Drains Any Credibility

Whatever credibility Dick Bove of Rochdale Securities has left can now be thrown out the window. It won’t matter at CNBC or Fox Business though, because for some reason he’s considered a guru analyst in the financial sector. Following Wells Fargo’s (WFC) earnings yesterday morning, he was on CNBC with the following comments before the market opened:

At the beginning of the segment he said Wells Fargo “has its loan losses under control” and that they “should be able to grow revenues by increasing loan volumes”. At the 1:20 mark he said Wells Fargo was one of the three financial companies that “should do well in the market today and lift all financial stocks.” To close out his thoughts on the financials, he called Wells Fargo a “standout” with those earnings numbers.

Now fast forward a few hours later to about 30 minutes before the market close yesterday. Bove issues a surprising Sell rating on Wells Fargo, downgrading the stock from Neutral. This morning he was on Fox Business explaining his Sell rating. Here are the highlights from his comments about Wells Fargo:

– not expanding its loan book

– margins on loans being sold going to come down

– big increase in loan losses through the beginning of next yeare

– unsustainable gains in their hedging portfolio

– will take about a year to get its position back where it should be

In response to the flip flop, Bove defended himself by saying he didn’t have all the results when he went on the air. Then why are you making an analysis?! Why not just say give me a few more minutes until I have all the facts. It’s irresponsible and reckless behavior at best.

Final Run Before Major Top In Gold Price By Early 2010: SPDR Gold ETF (GLD)

With gold breaking out of a 1.5 year base in recent weeks, it’s certainly been the focus of much discussion once again. How high will it go? Are we about to enter a mania phase? What’s the best way to play the sector? I thought I’d enter the fray and tackle some of these questions, primarily from a technical perspective. In this article I take a look at the SPDR Gold Trust ETF (GLD) in order to get an overview of where gold has been and where it might be headed. In Part II, which I’ll post towards the middle of the week, I’ll take a look at a few gold stocks that I think represent a good leadership group. That is, companies that are profitable and in some cases growing quickly. To close out the series, I’ll post another article later in the week or next weekend taking a look at several speculative gold plays based purely on momentum. These are trades that carry considerable more risk and potentially much greater reward.

With that, let’s jump into a couple charts of GLD which I think are quite revealing.

Continue reading Final Run Before Major Top In Gold Price By Early 2010: SPDR Gold ETF (GLD)

Where Is the Dollar, Gold & S&P500 Headed This Quarter?

Everybody is talking about the US dollar and how low it can go, about gold and how high it can go and most of all the market. Just when will a major correction take place in this market?

Of course there are no certainties in the market, but good technical analysis can give you probabilities and steer you in the direction of greater odds of success. Adam Hewison of Market Club just released a new video yesterday taking a look at the US Dollar, Gold and the S&P500. I have to agree with all the analysis in the video. You might be surprised to see the gold estimates and just how far the S&P could correct.

Video: see how to trade the big trends over the next couple of months.

Upcoming COP15 Climate Change Conference Trade Ideas

In just a few weeks on December 7th, a secret meeting of world leaders takes place that will undoubtedly go a long way in shaping how we live our lives. .. from the kinds of cars we drive, to how many hours we can run hot water, to how much we pay in electricity bills each month. The COP15 Climate Change conference in Denmark will provide extraordinary profit opportunities in what venture capitalist firm Kleiner Perkins Caufield and Byers said “could be the largest economic opportunity of the 21st century.” What is that opportunity? Cleantech. Everything from renewable energies, to energy efficiency, to water treatment and conservation. The opportunity in the coming years will be extraordinary and for those that position themselves, will reap the rewards.

Following the last meeting, international alternative energy companies such as Vestas Wind, Sunways and Climate Exchange PLC all skyrocketed and the profits could be bigger this time around. The big guys know this and are already positioning themselves. According to Green Chip Stocks International, Morgan Stanley, Citi and JP Morgan were given the inside scoop on COP15’s agenda last year and almost immediately mapped out their entire lending strategy for the next 40 years to be in synch with the $45 trillion global trend COP15 is responsible for. Some companies will be left in the dust while others will lead the way into the future.

Green Chip Stocks has more details on this extraordinary opportunity ..

Top IPO’s Of 2009 (Part II): GAME, LOGM, RST, TRIT, LIWA

Several days ago I posted what I thought were the top 5 IPO’s of 2009 and in this report I round it out with the next 5 best IPO’s of 2009. Please note that these are not ranked solely on performance, but rather on fundamentals such as earnings and sales growth, ROE and margins. No, this is not an extremely scientific ranking. You data junkies can crunch the numbers and run through your algorithms elsewhere 🙂

6. Shanda Games (GAME): This was one of the big IPO’s from last week, but didn’t perform as well as A123 Systems (AONE) out of the gates. After opening at $13, it sold off the rest of the day and closed below $11. Considering the run that the China gaming stocks have had, I think this IPO at this stage potentially marks a top in this sector. That’s not to say the growth won’t continue, it’s just that they have gotten ahead of themselves a bit.

Shanda Games is a spinoff of Shanda Interactive (SNDA). Certainly, the success of the Changyou.com (CYOU) spinoff from Sohu.com (SOHU) had something to do with the IPO. With the overall market risk appetite increasing and gaming stocks on fire, it makes sense. Shanda Games contributes 95% of the revenue of Shanda Interactive and the bulk of that revenue is concentrated in just two games. Still, that’s less of a risk than Changyou.com (CYOU), which gets most of its revenue from just one game. Shanda Games profits nearly doubled in 2008 over 2007 and the company is on pace to come close to that again here in 2009. Get more GAME analysis here.

7. Logmein (LOGM): Logmein provides remote access software enabling you to access your computer from anywhere. You can even access your desktop from your iPhone. Cool stuff! This is a small company that really started seeing some growth towards the end of 2007 and is expected to turn its first yearly profit here in 2009. Quarter over quarter revenue growth over the last 4 quarters has been impressive at 99%, 86%, 73% and 58% while EPS growth has come in at 108%, 150%, 200% and 289%. Growth is expected to moderate in 2010, but this remains a company to keep on the radar. Technically, it’s in the process of carving out its first base which may end up as a cup with handle. Get more LOGM analysis here.

8. Rosetta Stone (RST): Many people are familiar with this software company that makes learning a foreign language much easier. The company rolled out a high profile ad campaign during the Summer Olympics last year featuring Michael Phelps. Smart move because it helped generate awareness of the company ahead of the IPO less than a year later. While the stock has had a tough time gaining traction since the IPO launch on April 16th, and took a hit after lowering guidance about a month ago, this is still a company experiencing impressive growth. After stumbling in 2006 with a loss, it has bounced back in a big way, returning to profitability in 2007 and posting record profits last year. Here in 2009, the company is expected to grow EPS by another 40%. It’s going to be at least several weeks before the technical damage is repaired, but this is one company that must be on the radar. Get more RST analysis here.

9. Tri-Tech Holding (TRIT): In the first top 5 IPO report, I highlighted Duoyuan Global Water (DGW) as a top play on China water scarcity. I think Tri-Tech Holdings is a darn good play as well. The company develops and implements systems (both hardware and software) to assist government entities in monitoring and managing water supplies. It’s a very small company and a fraction of the size of Duoyuan, but the growth and profit potential is just as great, if not greater in my opinion. The stock has already doubled in price following the IPO on September 10th and I don’t think it’s done. I’m looking for one of two things for an entry – one entry would be on a filling of the gap just below 12 and another entry would be a breakout from the first consolidation period of at least two weeks. Get more TRIT analysis here.

5. Lihua International (LIWA): Rounding out my top 10 IPO’s of 2009 list is another Chinese company which also IPO’d in September. Lihua is relatively off the IPO radar of most and that’s just the way I like it. The stock has also doubled in price following the IPO and has yet to digest gains. I think a breakout from the first consolidation period of at least two weeks offers an entry point.

Lihua makes copper wire for a variety of industries including automotive, electronics and telecom. A great pick and shovel play on China’s continued growth. While growth hasn’t been as spectacular as some China companies and the company can be inconsistent at times, the overall growth is very strong. The company posted EPS growth of 72% in 2007, 38% last year and is on pace for growth of around 25% here in 2009. Get more LIWA analysis here.

Honorable Mention: NIVS Intellimedia (NIV), Opentable (OPEN), Medidata Solutions (MDSO)

Disclaimer: I don’t own any of the stocks mentioned above.